What are you looking for?

![Find My Professional]() Find My Professional

Find My Professional

Find your dedicated professional.

![Search By Zipcode]() Search By Zipcode

Search By Zipcode

Allocate the nearest professional to you by typing zip code.

![Join Our Network]() Join Our Network

Join Our Network

Join our team of professionals and become your own boss.

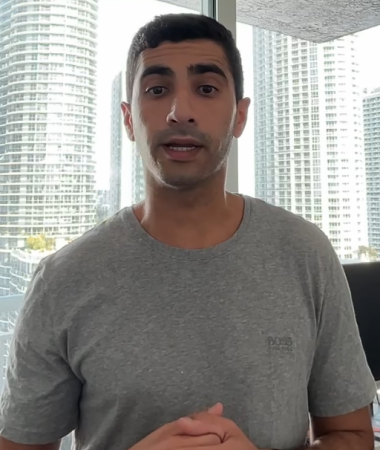

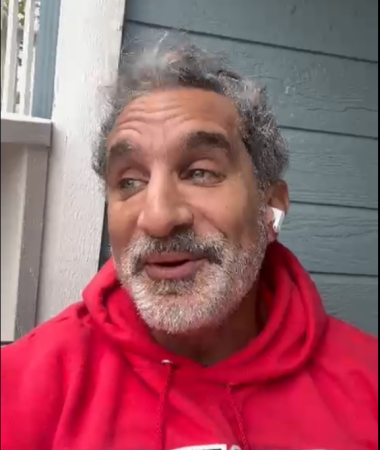

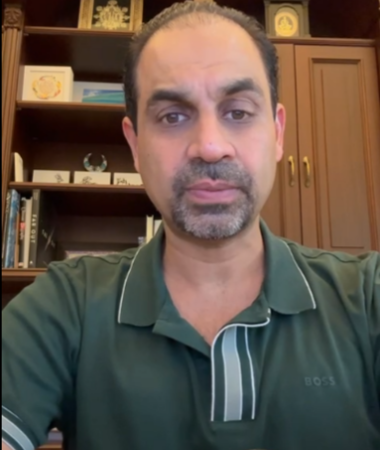

WHO WE ARE

At Accountants on Air (AOA), we're revolutionizing the way your accounting and tax resolution service needs are met by merging personalized support from our experts with the flexibility of on-the-go technology.

We’re a team of specialists that can help you take all of the hassle out of your accounting and tax obligations and give you more time to do the things you really love. Our team is highly skilled and can help to achieve your objectives in a more convenient, ethical and cost-effective manner.

As Seen On

WHO WE SERVE

How It Works

Connecting you with the World’s Largest CPA Network

Speak with A Specialist

To identify your Business Needs and Assess the Scope of work

Customize Your Services

Where fits your needs and your Pocket

We Work for You

We match you with the professional who meets your needs

- E-ACCOUNTING

- E-FILING

- E-BOOKKEEPING

- E-EVERYTHING

Find My Professional

Find My Professional Search By Zipcode

Search By Zipcode Join Our Network

Join Our Network Advisory

Advisory Audit & Assurances

Audit & Assurances Accounting

Accounting Tax Services

Tax Services