Dramatic increases in trading volume can alert crypto investors to price highs that are yet to come.

An uptick in trading volume is one of the key components of a digital asset’s healthy market outlook. It indicates both robust liquidity and a surge in fellow traders’ enthusiasm for the token. The relationship between the asset’s price and trading volume is a nuanced one: Volume spikes often trail strong rallies as more and more traders hop on the bandwagon in the hopes of a ride to the moon.

Yet, in some cases, it is surging trading volume that leads to price appreciation. In such a scenario, getting alerted to anomalous trading activity around a token can help crypto investors to spot the early signs of an impending rally. Regardless of whether the trading volume spikes precede or follow the price action, the assets that exhibit unusual behavior on this key metric merit a closer look.

The five assets featured below showed the greatest week-to-week increases in trading volume last week and were featured in the Unusual Trading Volume section ofCointelegraph Markets Pro dashboard. In three cases out of five, anomalous upticks in trading volume foreshadowed major price increases.

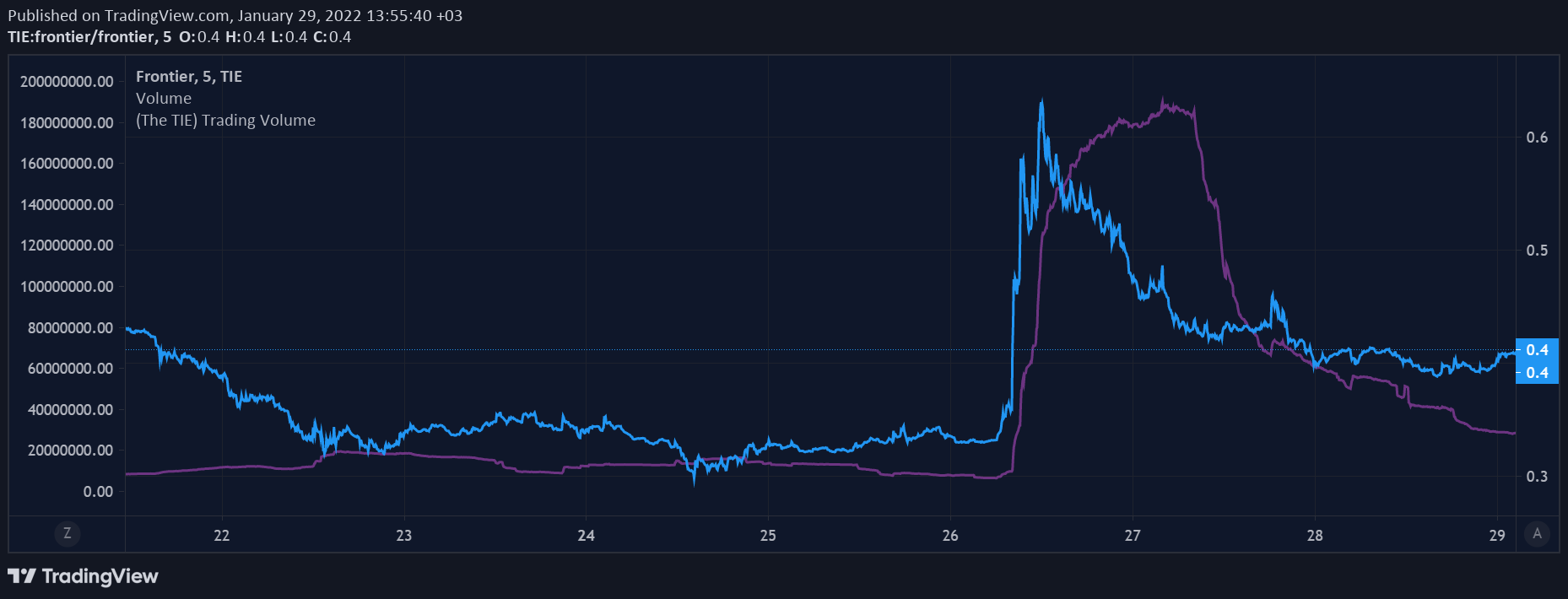

FRONT: Trading volume explosion following an exchange listing

FRONT, a token representing DeFi aggregator Frontier, topped the chart of last week’s trading volume movers chart with a 3041% increase on the heels of its listing on the Korean crypto exchange Bithumb. As evident in the graph, the Jan. 26 listing announcement had first triggered a price spike as the coin’s value almost doubled, soaring from $0.41 to $0.78 in less than 6 hours. FRONT’s trading volume followed the price dynamics closely, peaking the day after the announcement.

QKC: A minor price pump anticipates a price peak

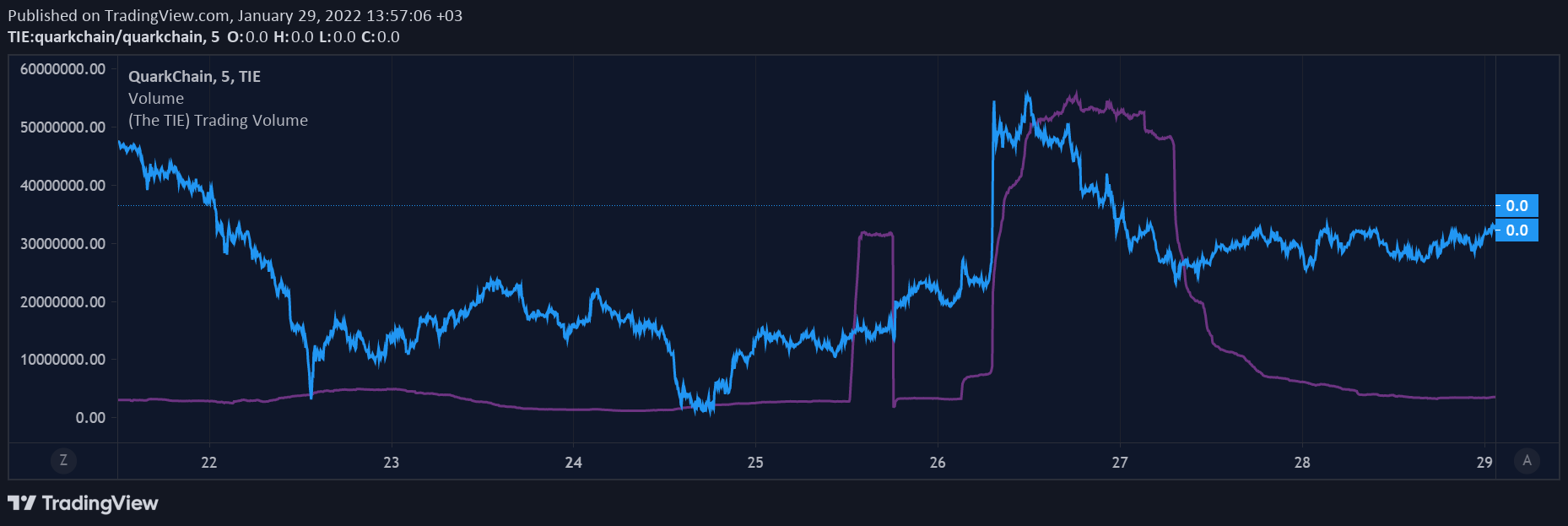

QKC price (blue) vs. trading volume (purple), Jan. 22–29. Source: TradingView/The TIE

QuarkChain (QKC) saw two dramatic trading volume increases last week, the greater one (+2862%) coming last and following the coin’s weekly price high. In a curious plot twist, there was also another, rather short-lived trading volume spike that came on Jan. 25 and preceded the price rally by roughly 18 hours.

WAVES: Price wave first, trading volume wave second

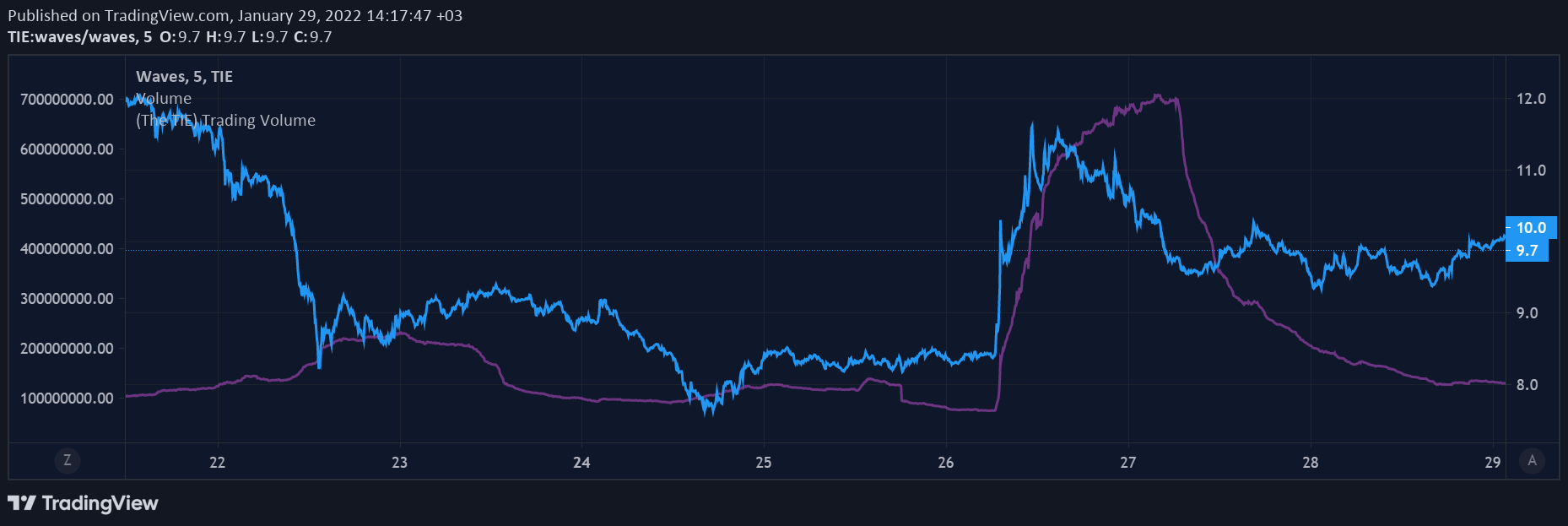

WAVES price (blue) vs. trading volume (purple), Jan. 22–29. Source: TradingView/The TIE

At the height of its trading volume momentum that came on Jan. 27, WAVES registered an 860% increase compared to the week before. The volume pump followed a sharp price increase as the token shot up from $8.39 to $11.38 in about 5 hours. Trader activity remained high even as the price began to correct.

Any single metric that shapes an asset’s market outlook can be uninformative on its own, yet it becomes much more useful when contextualized within a host of other variables that the VORTECS™ algorithm considers, such as price movement, social sentiment and tweet volume.

Author: BEAU LINIGHAN