The One Big Beautiful Bill Act (OBBBA) is the most comprehensive tax and policy reform passed in recent years. Signed into law in 2025, the bill touches nearly every sector of the economy—impacting individuals, business owners, healthcare providers, and even farmers.

x

What are you looking for?

29August

Tax

ByAccountants on Air Team

Comments0

Likes

Tax

Share this blog

2December

Tax

ByAccountants on Air Team

Comments0

Likes

Tax

Tax Filing Due Dates for 2025

As we approach the new tax year, staying informed about key deadlines is critical to ensure timely compliance. Below is a comprehensive guide to federal tax filing due dates for various forms and entities for 2025.

Share this blog

4August

Tax

ByIRS

Comments0

Likes

Tax

Most U.S. citizens – and

Share this blog

25November

Tax

ByA. Liberati

Comments0

Likes

Tax

Are you looking forward to just drop all paperwork that you can find for 2022 to your Tax Preparer for the 2023 Tax Filing Season?

Share this blog

22April

Tax

ByIRS

Comments0

Likes

Tax

Need more time to prepare your federal tax return? This page provides information on how to apply for an extension of time to file. Please be aware that:

An extension of time to file your return does not grant you any extension of time to pay your taxes.

You should estimate and pay any owed taxes by your regular deadline to help avoid possible penalties.

You must file your extension request no later than the regular due date of your return.

If you don't know where to start you can always contact us and hire an expert to do it for you.

Share this blog

13April

Tax

ByTrulock J.

Comments2

Likes

Tax

Below are the 2022 US tax deadlines for the 2021 tax year.

January 18, 2022

Deadline for Individuals to pay Quarter 4 of their 2021 Estimated Income Tax payment. If you have income that does not have US Federal tax withholding or the income cannot be offset using deductions or foreign tax credits, pay your estimated taxes by this date using Form 1040-ES.

March 6, 2022

Share this blog

1April

Tax

By

Comments0

Likes

Tax

The April 18 tax deadline is quickly approaching. If you haven’t filed your taxes yet and are starting to feel the pressure, you’re not alone. According to a recent IPX 1031 survey, one-third of Americans say they wait until the last minute to file their taxes. But if tax season snuck up on you this year, there’s no need to panic — you can always request a tax extension.

Share this blog

6October

Tax

ByIRS

Comments0

Likes

Tax

Oct. 15 deadline approaches for taxpayers who requested extensions to file 2020 tax returns

WASHINGTON — The Internal Revenue Service today reminds taxpayers about the upcoming October 15 due date to file 2020 tax returns. People who asked for an extension should file on or before the extension deadline to avoid the penalty for filing late. Electronic filing options, such as IRS Free File, are still available.

Share this blog

30September

Tax

ByIRS

Comments0

Likes

Tax

The Work Opportunity Tax Credit (WOTC) is a Federal tax credit available to employers for hiring individuals from certain targeted groups who have consistently faced significant barriers to employment.

WOTC joins other workforce programs that incentivize workplace diversity and facilitate access to good jobs for American workers.

Share this blog

24September

Tax

ByIRS

Comments0

Likes

Tax

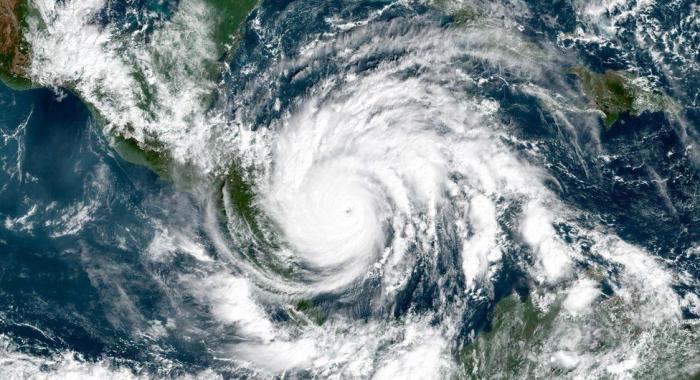

WASHINGTON — September is National Preparedness Month. With the height of hurricane season fast approaching and the ongoing threat of wildfires in some parts of the country, the Internal Revenue Service reminds everyone to develop an emergency preparedness plan.

All taxpayers, from individuals to organizations and businesses, should take time now to create or update their emergency plans.

Share this blog