Tax credits are the gold nuggets of the tax world. Qualifying for one feels better than finding $100 in your pants pocket. Here’s a brief look at how some of the most common ones work — maybe you’ll find some cash here, too.

Here are a few common ones for people raising kids, saving for retirement, paying for college or just buying stuff.

What is a tax credit and how does it work?

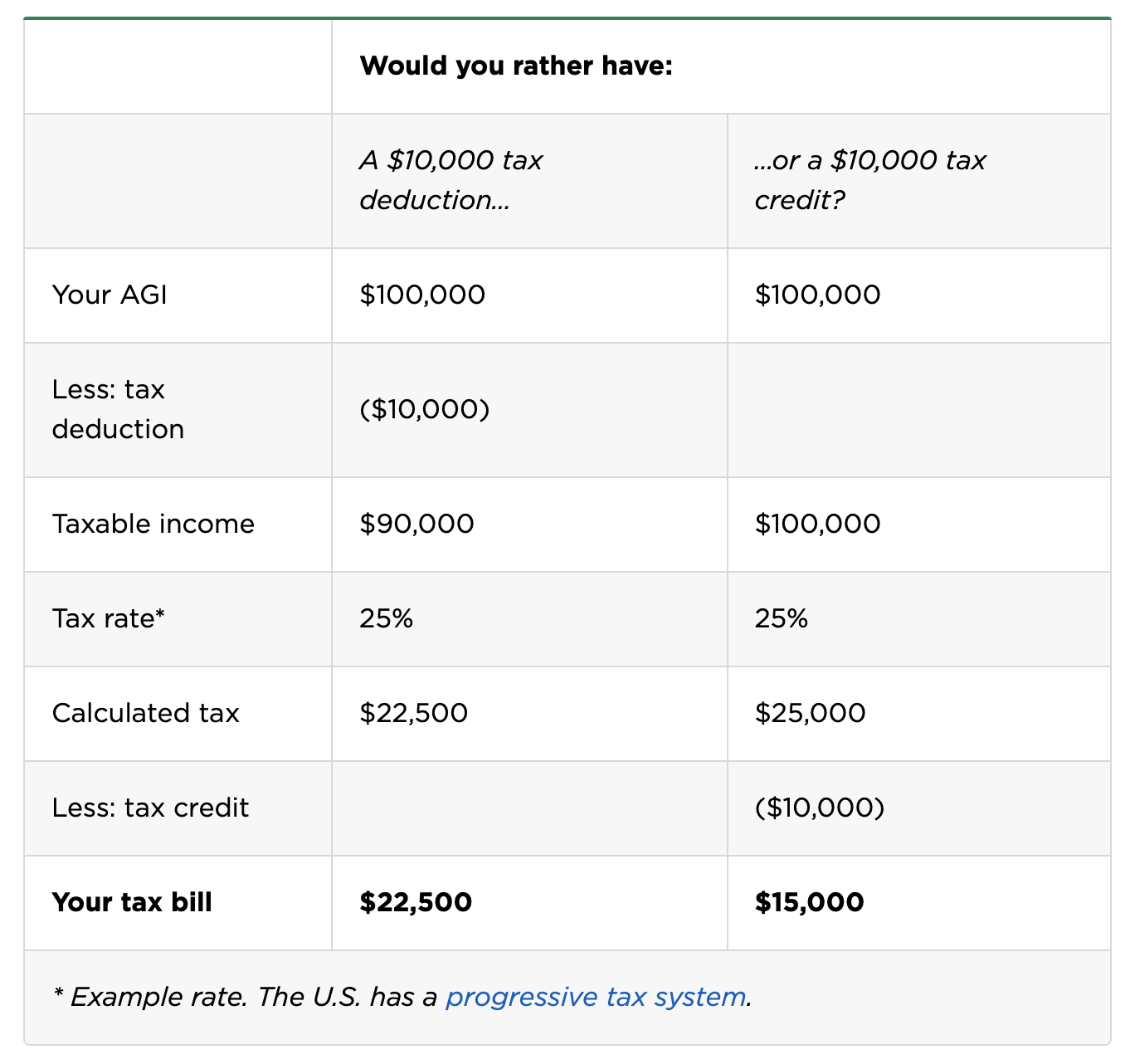

Be sure you know the difference between a tax deduction and a tax credit.

- A tax credit is a dollar-for-dollar reduction in your actual tax bill. A few credits are even refundable, which means that if you owe $250 in taxes but qualify for a $1,000 credit, you’ll get a check for $750. (Most tax credits, however, aren’t refundable.)

- This differs from a tax deduction, which is a dollar amount the IRS allows you to subtract from your adjusted gross income (AGI), making your taxable income lower. The lower your taxable income, the lower your tax bill.

Either way, as the simplified example in the table shows, a $10,000 tax credit makes a much bigger dent in your tax bill than a $10,000 tax deduction does.

Some of the most popular tax credits fall into three categories. These are just summaries; tax credits have lots of rules, so it's a good idea to consult a tax professional. Your state may offer a variety of tax credits as well.

1. Tax credits for people with kids

Child tax credit. This could get you up to $3,600 per kid.

The higher your income, the less you’ll qualify for. You may qualify for the full credit only if your modified adjusted gross income is under:

- In 2020: $400,000 for married filing jointly and $200,000 for everybody else

- In 2021: $75,000 for single filers, $150,000 for married filing jointly and $112,500 for head of household filers

Child and dependent care credit. Generally, in 2020 it’s up to 35% of up to $3,000 of child care and similar costs for a child under 13, spouse or parent unable to care for themselves, or another dependent so you can work — and up to $6,000 of expenses for two or more dependents. In 2021, it's up to 50% of $8,000 in care costs for one dependent or $16,000 for two or more dependents.

- The percentage of allowable expenses decreases for higher-income earners — and therefore the value of the credit also decreases.

- For the 2020 tax year, this credit isn't refundable, which means it can take your tax bill down to zero but you don't get the leftovers. For the 2021 tax year, however, this tax credit is refundable.

- Payments made out of a dependent-care flexible spending account or other tax-advantaged program at work may reduce your credit.

Earned income credit. This credit will get you between $538 and $6,660 in tax year 2020 depending on how many kids you have, your marital status and how much you make. For 2021, the earned income credit ranges from $543 to $6,728 depending on tax-filing status and number of children.

- If your AGI was less than about $57,000 in 2020, it’s something to look into, though if you had more than $3,650 of investment income, dividends, capital gains and a few other things in 2020, you won’t qualify.

- Note: You can get up to $538 in 2020 from the earned income credit even if you don’t have kids, though only if your income is less than $15,820 as a single filer or $21,710 if you’re filing jointly.

- For the 2020 tax year, there are special rules due to coronavirus: You can use either your 2019 income or your 2020 income to calculate your EITC, and you can use whichever number gets you the bigger EITC. (This is also the case for the Child Tax Credit.) Be sure to ask your tax preparer to run the numbers both ways.

Adoption credit. For the 2020 tax year, this covers up to $14,300 in adoption costs per child. In 2021, it rises to $14,440.

- For 2020, the credit begins to phase out at $214,520 of modified adjusted gross income, and people with AGIs higher than $254,520 don’t qualify. For 2021, the credit begins to phase out at $216,660 of modified adjusted gross income, and people with AGIs higher than $256,660 don’t qualify.

- Also, you can’t take the credit if you’re adopting your spouse’s child.

- People who adopt children with functional needs can get up to the full credit even if their actual expenses were less.

2. Tax credits for investing in education or for retirement

The saver’s credit: This runs 10% to 50% of up to $2,000 in contributions to an IRA, 401(k), 403(b) or certain other retirement plans ($4,000 if filing jointly). The percentage depends on your filing status and income, but generally it's something to look at if your AGI in 2020 was less than $65,000 if married filing jointly, $48,750 if head of household and $32,500 if single.

American Opportunity credit: This credit runs up to $2,500 per student for tuition, activity fees, books, supplies and equipment during the first four years of college.

- The student must be enrolled at least half time and can’t have any felony drug convictions.

- You may not qualify if your AGI is higher than $90,000 as a single filer or $180,000 as a joint filer. In 2021, the thresholds are $80,000 for single filers and $160,000 for joint filers.

- Parents can take the credit if they qualify and claim the student as a dependent on their return.

Lifetime Learning credit: With this credit, you can get up to $2,000 for tuition, activity fees, books, supplies and equipment for undergraduate, graduate or even non degree courses at accredited institutions.

- Unlike the American Opportunity credit, there’s no workload requirement.

- The $2,000 limit is per return, not per student, so the most you can get back is $2,000 regardless of how many students you pay expenses for.

- You may not qualify if your modified AGI is higher than $68,000 as a single filer or $136,000 as a joint filer in 2020. In 2021, the thresholds are $80,000 for single filers and $160,000 for joint filers.

- You can claim both the American Opportunity Credit and the Lifetime Learning Credit on the same tax return, but you can't claim both for the same student.

3. Tax credits for big-ticket 'green' purchases

Residential energy tax credit: This one gets you up to 26% of the cost of solar energy systems, including solar water heaters and solar panels. The credit dwindles to 22% in 2023 and expires in 2024.

Plug-in electric-drive motor vehicle credit: You could get up to $7,500 for buying a plug-in electric vehicle. The credit is $2,500 or 10% of cost depending on number of wheels and battery capacity. You must buy new; used vehicles don’t count.

Author, Orem. T. (2021, 03 27). What Tax Credits Can I Qualify For This Year? A Guide. Nerdwallet.

https://www.nerdwallet.com/article/taxes/what-tax-credits-can-i-qualify-for?